Hogan & Stickel, Inc. is focused on income tax, estate tax, gift tax, and charitable planning for individuals and businesses.

We represent clients in structuring business transactions, as well as planning their charitable giving, income and estate tax matters. Individual and business clients alike rely on resourceful and responsive attorneys to effectively minimize the impact of income taxes, gift taxes, estate taxes and generation-skipping transfer taxes for both themselves and their heirs. Through the strategic use of cutting-edge and traditional income- and asset-transfer devices, we work to help you take full advantage of all applicable tax credits, deductions, exemptions and elections, so you can transfer your wealth with maximum benefit for your business, your family and your philanthropic beneficiaries.

We provide experienced tax advice to individuals, executors, trustees and businesses in a wide range of tax areas. There are many tax consequences to legal decisions, especially those that involve asset protection and estate planning. The proper legal decisions can only be made with a complete understanding of the resulting tax consequences. In addition, the CPA at Hogan & Stickel, Inc. can assist you with federal and state income tax returns for individuals, estates, trusts, corporations, LLCs and partnerships. Our CPA can also assist with federal estate and gift tax returns.

We provide general tax advice, including:

Website copyright © 2000-2026 Hogan & Stickel, Inc.

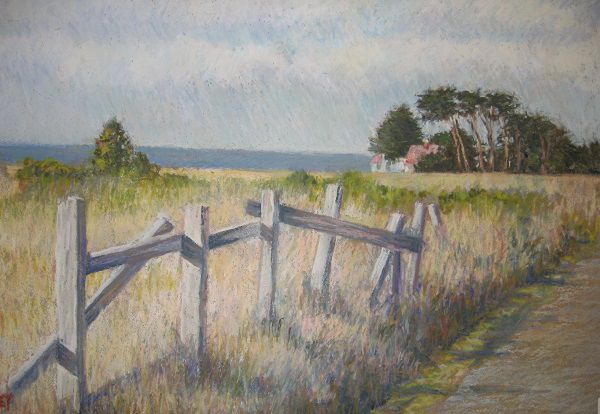

Art displayed throughout our website is the copyrighted work of Eleanor Harvey. ©2000-2019

Hogan & Stickel, Inc., located in Fort Bragg, California, serves clients along the Mendocino Coast and throughout Mendocino County.

This website is posted to provide general information only. The information presented herein is not meant to be construed as formal legal advice; neither does it constitute the formation of a lawyer-client relationship with any visitor.